March Madness: The Fifth Straight Year of Extreme Corporate Tax Avoidance

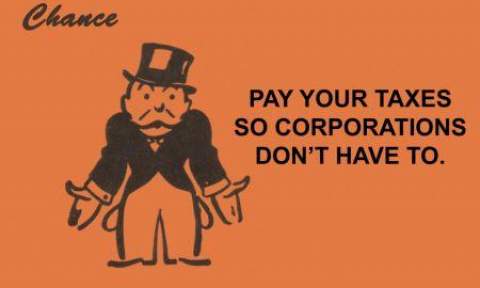

Nation of Change has just published an article on corporate tax avoidance in the USA. As they grimly note:

Corporations have simply stopped paying their taxes, perhaps using the 2008 recession as an excuse to plead hardship, but then never restoring their tax obligations when business got better. The facts are indisputable. For over 20 years, from 1987 to 2008, corporations paid an average of 22.5 percent in federal taxes. Since the recession, this has dropped to 10 percent—even though their profits have doubled in less than ten years.Drawing on data from Pay Up Now which had used SEC data issued by the companies themselves, the article lists the top sixteen corporate tax cheats and declares the winner:

No one wins this game. In a financial sense they do, but the gains are outweighed by the greed and irresponsibility of tax avoidance.The companies involved will doubtless say they just act within the law, but as Bloomberg revealed today in a blistering attack on the number one rule-setter, the OECD, the companies have shaped the rules for decades, and sure as heck aren't in a hurry to remedy the problems.

0 Comments:

Post a Comment

<< Home